The coal-powered Rush Island Energy Center in Jefferson County will be shut down on October 15. The 1,178-megawatt energy center has been operating since 1976 and can power nearly one million homes. Rush Island was originally slated to operate through at least 2039, but the plant was found to be in violation of the Clean Air Act by a federal court more than a decade ago. Ameren was given the choice of installing pollution control mechanisms (scrubbers) or shutting the plant down, and decided to close Rush Island.

Rush Island is not the first coal plant to be shuttered, and it will not be the last. At the end of 2022, the 827-megawatt Meramec Power Plant was shut down, and according to Ameren, it plans to phase coal out completely by 2045.

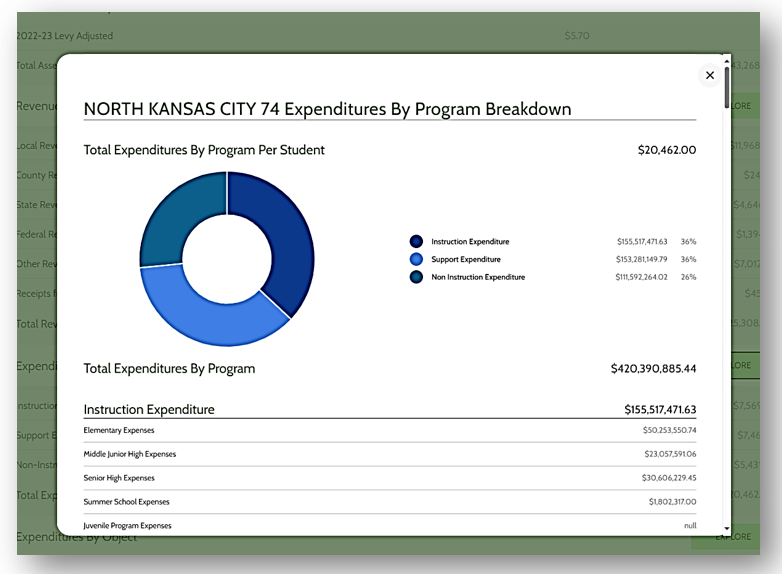

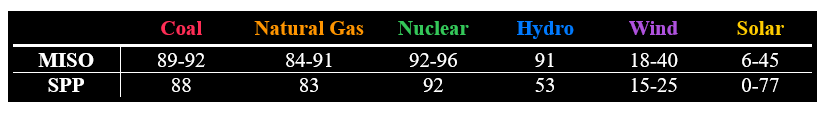

Below is a summary of Ameren’s 2023 Integrated Resource Plan:

Note: “Other Zero Carbon” is expected to include a combination of renewables, energy storage, nuclear energy, and new technologies.

The continued shuttering of reliable coal plants presents concerns for energy reliability and affordability.

Is there reason to be concerned with affordability?

North Carolina is another state on the path of shutting down all coal plants and inserting renewables largely in their place. In response to these state plans, the John Locke Foundation and Center of the American Experiment released an in-depth analysis of the state’s proposed paths forward. The analysis finds that North Carolina’s proposed plan would cost more than a more nuclear-focused one. This is largely attributed to the “build and rebuild” treadmill that wind and solar assets need due to their short lifespan (roughly 20 years), whereas nuclear plans have a lifespan of 80 years (and maybe more).

Utilities, like Ameren, are allowed to charge enough for electricity to cover the cost of providing the service to everyone in their territory, plus a government-approved profit, often set at 5–-10 percent, on their capital investments. As long as the expenses are approved by the regulator in their state, utilities make a profit on every dollar they spend on new builds such as wind turbines, solar panels, natural gas plants, or even renovating corporate offices. The more money utilities spend, the more money they make.

A Missouri-specific study of Ameren’s energy plans could be beneficial to future policy research. Nevertheless, there is some reason to be skeptical of the affordability of such a massive energy transition and continued research will be needed as technology changes.

What concerns are there with reliability?

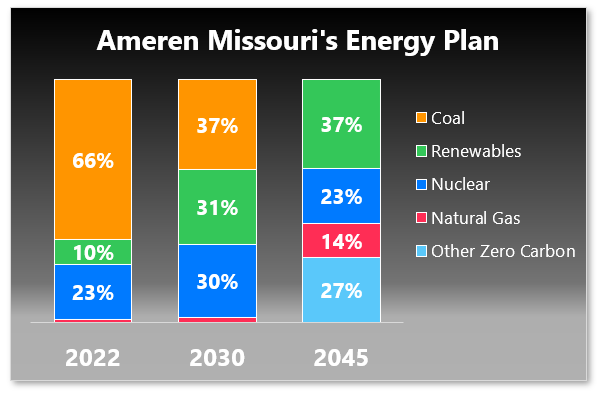

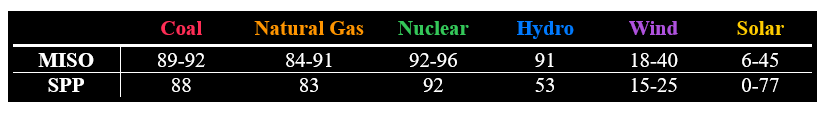

Some sources of energy are more reliable than others, and there are numerous ways to measure this: accredited capacity, unforced capacity (UCAP), or capacity value. All three measure the general reliability value to the grid. The figure below displays capacity values for the two main regional energy organizations in Missouri—Midcontinent Independent System Operator (MISO) and Southwest Power Pool (SPP):

Solar and wind, which are projected to replace much of the energy that retiring coal plants have produced, are intermittent and do not provide consistent streams of electricity, nor are they available at all times of day (although battery storage is improving). As shown in the table above, MISO rates the reliability of solar and wind far lower than coal and other replacement options. Relying so heavily on them may be dangerous.

There is also the task of building out a vast amount of advanced transmission infrastructure. The New York Times reports: “Already, a lack of transmission capacity means that thousands of proposed wind and solar projects are facing multiyear delays and rising costs to connect to the grid.” We should not bank on the ability to break this trend.

Will Ameren be able to replace 66% of its current generation while also meeting the needs of rapidly rising electricity demand? There is reason for concern. In my next post, I will discuss one policy that could help maintain and strengthen the reliability of our grid.

*Note: This post was updated on October 23 to more accurately reflect the circumstances of Rush Island’s closure.