A version of this commentary appeared in the Examiner.

It’s an obscure state law that every article about government and politics in Kansas City has to include a quote from Harry Truman. As I follow the controversy over the reassessment process in Jackson County, I flash back to my own time working for St. Louis County government during the 2001 “drive-by assessment” scandal. That, in turn, reminds me of this quote from our 33rd President: “The only thing new in the world is the history you do not know.”

In the Spring of 2001, the St. Louis County Assessor had a problem. An enormous number of homes were coming back with a reassessment appraisal increase greater than 17 percent, meaning that a physical (in-person) inspection would be required. The problem was that the assessor had neither the time, the staff, nor (apparently) the desire to schedule in-person inspections of tens of thousands of properties. The solution? Quietly redefine what “physical inspection” meant. The assessor’s office plotted tens of thousands of properties with large valuation increases on maps (probably using Mapquest; Google maps hadn’t been designed yet) and sent assessors off driving around the county. Driving past a house and looking at it was considered a physical inspection. Problem solved, right?

Wrong. Assessments ballooned throughout the county. Taxpayers were livid. They called their council members screaming. A few of them, including my soon-to-be boss, started to investigate. They asked for the filed inspection reports. Once it became clear that individual assessors had somehow been doing several hundred “physical inspections” per day, the scheme was exposed and the scandal exploded.

Huge valuation increases. A poorly managed assessor’s office. Angry taxpayers. Politicians trading blame. Does this sound familiar to residents of Jackson County?

If you look at the property valuations in Jackson County from a decade ago and compare them to valuations in St. Louis, it is hard to dispute that Jackson County property, overall, was underassessed. That is the only partial defense I’ll give to the Jackson County executive and assessor. But for multiple cycles now, especially in 2019 and 2023, the assessor’s office has done a shockingly poor job of managing the reassessment and adhering to the rules of the process. Nobody likes seeing their valuations go up at tax time, but 113 other counties in Missouri seem to be able to reassess property without the process failures that have plagued Jackson County. Taxpayers in Jackson County have every right to be angry.

Taxpayers in St. Louis were angry in 2001, too. Almost immediately, the assessor and revenue director were fired. While it took a few more years, that demand for reforms to the reassessment process led to real change locally and statewide. The law was clarified to define a physical inspection as just that, and the trigger point for an inspection (with homeowner consent, of course) was reduced to the present 15 percent increase in value. Requirements for tax-rate rollbacks by governments were enhanced. Eventually, the St. Louis County charter was changed to make the assessor an elected position. While the present process is far from perfect in the rest of Missouri, the changes that emerged from that 2001 scandal have benefited the entire state.

Which brings us back to Jackson County. Voters and taxpayers need to demand reform. There is already an effort to change the law to elect the assessor, which seems like an obvious improvement. Another change that is needed is to end the tax-rate rollback exemption for the Kansas City School District. Despite its substantial increase in assessed values in 2023 (which is still being contested in court), the district voted once again to keep its tax rate the same. Every other taxing body in Missouri has to roll its tax rate back to at least partially offset assessment increases, but the Kansas City School District gets to enjoy its windfall on the backs of taxpayers. Finally, Jackson County could consider using variable property tax rates, as St. Louis County does, to allow for greater ability to adjust rates by property type in response to future changes.

Other changes would be easier and don’t require amending the law. Why the Jackson County assessor still has her job after all this mismanagement is a mystery to me.

The 2001 reassessment disaster in St. Louis led to improvements to the overall process that are still in place today, at least everywhere but in Jackson County. Hopefully, the ongoing controversy over the 2023 reassessments in Jackson County can lead to similar, lasting reforms. Jackson County taxpayers deserve nothing less.

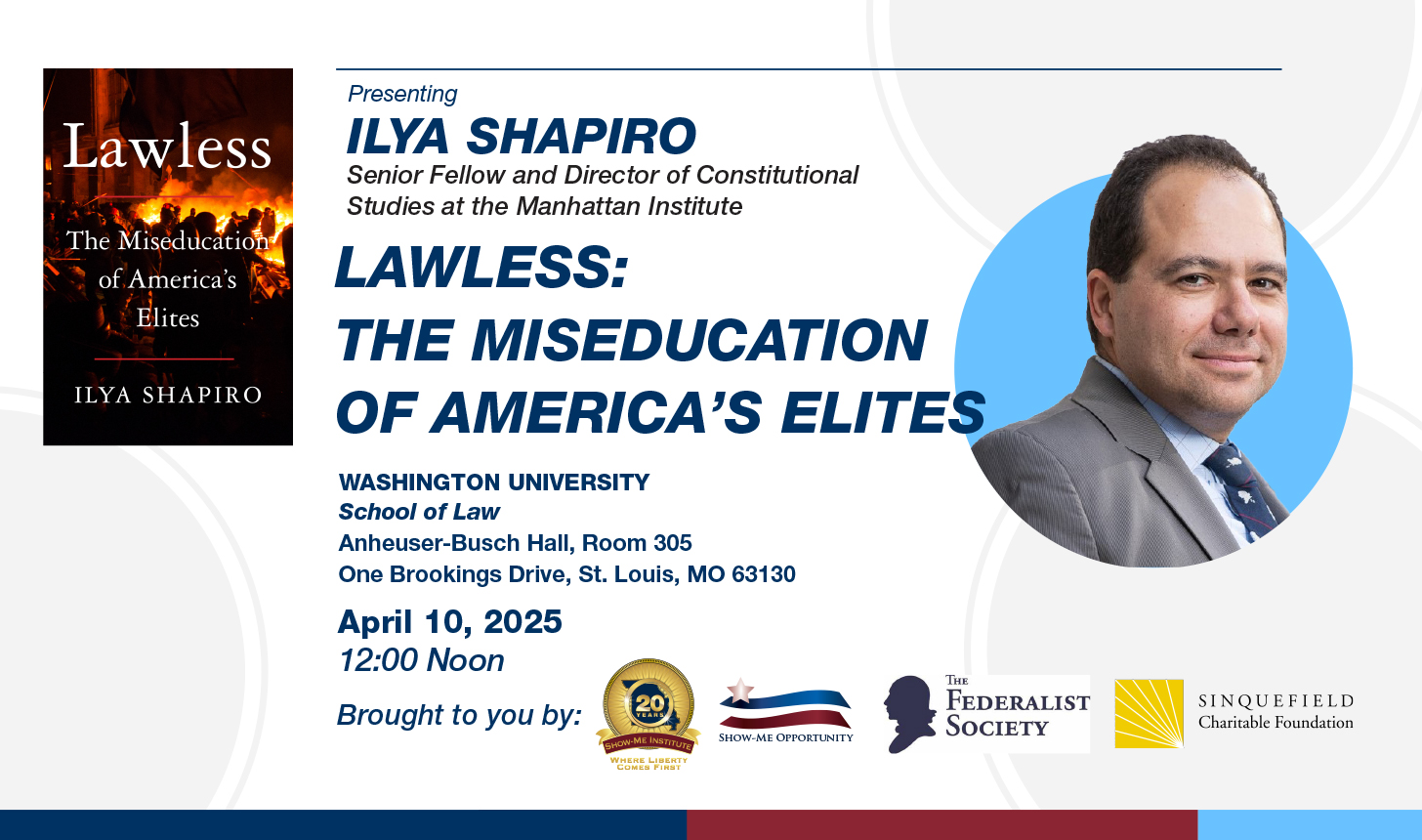

In partnership with the WashULaw Federalist Society, the Show-Me Institute is pleased to present Ilya Shapiro, senior fellow and director of constitutional studies at the Manhattan Institute, for a discussion of his new book, Lawless: The Miseducation of America’s Elites.

In partnership with the WashULaw Federalist Society, the Show-Me Institute is pleased to present Ilya Shapiro, senior fellow and director of constitutional studies at the Manhattan Institute, for a discussion of his new book, Lawless: The Miseducation of America’s Elites.