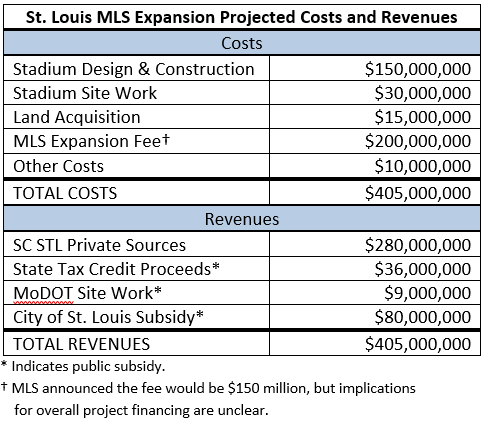

A group of local businesspeople (SC STL) is trying to lure a Major League Soccer (MLS) team to the Gateway City. The only catch is that SC STL is asking Saint Louis taxpayers to cough up an extra $80 million in new taxes to support the venture. In addition, as the Business Journal reports, SC STL is also asking for $40 million from the state of Missouri. Altogether, SC STL hopes taxpayers will pick up $129 million of their projected $405 million in costs. Below is a breakdown of those projected costs and revenues.

The state just cut $50 million (including $40 million from Medicaid) from its budget due to shortfalls. So how can it afford to chip in $40 million for a sports stadium? And what could justify placing a new burden on taxpayers for a project that Governor-elect Eric Greitens recently described as “nothing more than welfare for billionaires?” Perhaps Greitens will find out from SC-STL investors directly; earlier today they asked to meet with the Governor-elect to discuss the proposal before moving it along any further.

One recent claim is that taxpayers, the state, and the city itself will see big returns on their investment. That is: (1) the economy will grow, (2) jobs will be created, and (3) the city and state will see increased tax revenues. But do any of these promises stand up to scrutiny?

- Economists are divided on many issues, but on the economic impact of sports stadiums there is broad consensus. The research is clear: major league sports stadiums have a negligible effect on the economy. Rather than create new economic activity, stadiums simply rearrange existing activity. Sure, people will spend money at a new stadium, but it’s likely that most of those dollars would have gone to movie theaters and restaurants, etc., had the stadium never opened.

- But what about all the jobs created by the stadium? To the extent that those jobs are funded with taxes, they are funded with money being taken out of the economy. But more importantly, the 1,883 projected construction and permanent jobs that backers project the stadium would generate would cost taxpayers more than $68,500 each!

- What about the claim that the stadium will boost local tax revenue and thereby improve basic government services? For one, just as the economic activity at the stadium would have happened somewhere, so too the taxes collected at the stadium would be have been collected somewhere in the region. It’s doubtful the city or state will see any significant new revenues from the stadium. But, more importantly, the city shouldn’t embark on a risky venture with taxpayer money just for the chance to increase its own revenue.

Researchers find that stadium benefits are often overstated and oversold (see here, here, here, here, here, and here). Missourians should demand that the city produce what dozens of economists could not—credible evidence that a stadium investment will produce returns for Missourians—before agreeing to subsidize this project.