Policymakers in Jefferson City passed Senate Bill 49 (SB 49), which allows for a sales tax of one eighth of one percent to be levied in Saint Louis City and County for construction, maintenance, and operations at the Saint Louis Zoo. The bill itself doesn’t impose the sales tax, but simply allows a ballot to be submitted to voters. Voters in the city and county would have the final say on whether or not to impose the extra tax.

The version of the bill in front of the Governor has changed since it was first introduced. Previous drafts would have allowed for similar sales tax hikes in Saint Charles, Franklin, and Jefferson counties. The narrower focus of the bill means distant shoppers won’t have to subsidize the zoo (which is fair), but it also means a smaller portion of the public will shoulder the burden of supporting a “free” zoo. It also means city and county taxpayers could be taxed twice for the zoo.

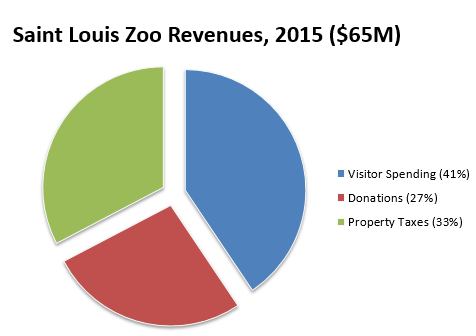

Currently, the zoo is supported by visitor spending, donations, and a property tax levied in Saint Louis City and County. So if a sales tax is passed, city and county voters will pay two taxes for the zoo. And while taxpayers would get an improved zoo for that extra money, the new funding wouldn’t fix the underlying problem with the zoo’s funding structure: free riders.

Since no admission is charged at the zoo, city and county taxpayers support the zoo for everyone, from Saint Charles residents to visitors from Hawaii. Predictably, the issue of fairness arises: why should just city and county residents pay for the zoo? While some propose a regional taxing structure to remedy the free-riding problem, in reality it would convert only a portion of the free riders into supporters. A fairer solution would be to charge admission for those not paying zoo property taxes. (For perspective, a $2 admission fee for residents outside the city and county, assuming a 10% reduction in visitors, could raise more than $3.5 million a year.)

A zoo sales tax would worsen the ever-growing sales tax burden for city residents. With the passage of the MetroLink sales tax hike in April, the city’s sales tax rate jumped to 9.179%, the 13th highest of major US cities (and higher than in New York City, Los Angeles, and San Francisco). If a zoo tax were to be approved, the city’s base rate would top 9.3%, and in some areas littered with special taxing districts, be as high as 11.3%. For many city families, these tax increases mean hundreds of dollars a year they cannot spend on food, school supplies, and other goods and services.

We all love the zoo, and there’s no denying it could use some cash for infrastructure and other projects. But taxpayers should think hard about whether sales taxes are a fair way to fund this famous Saint Louis institution.