The Latest GDP Report: What Does It Mean for 2023?

While Washington, D.C., is seized by speculation surrounding debt ceiling showdowns and the specter of government default, other recent news—namely, the latest report from the Bureau of Economic Analysis on the nation’s gross domestic product (GDP)—provided some welcome but qualified good news on the economy. According to the report, inflation-adjusted (real) GDP grew by 2.9% on an annualized basis in the fourth quarter of 2022, which modestly exceeded consensus expectations. Moreover, unlike the third quarter data—which showed growth despite a large decline in private domestic investment—each of the topline spending categories showed growth in the fourth quarter, albeit meager growth in some cases.

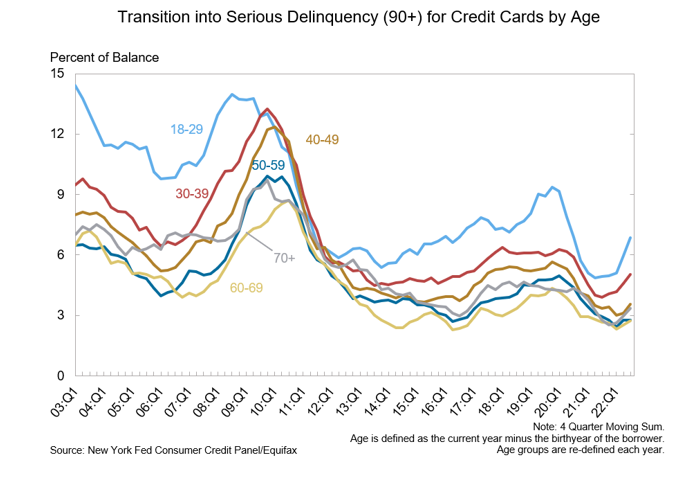

First of all, consumer spending is holding up. After only growing by 1.3% in the first quarter of 2022, it ended the year growing at a 2.1% clip—hardly robust, but clearly in positive territory. Consumers have been slammed by high inflation and eroding purchasing power for the better part of two years, but the steady job market and still-elevated checking account balances of households have managed to keep them afloat. Unfortunately, so too has rapid growth in credit card utilization, which may act as a source of financial vulnerability for consumers going forward as they grapple with continued interest rate hikes. Transitions into credit card delinquency are already on the rise, driven especially by households in the 18–29 and 30–39 year age ranges.

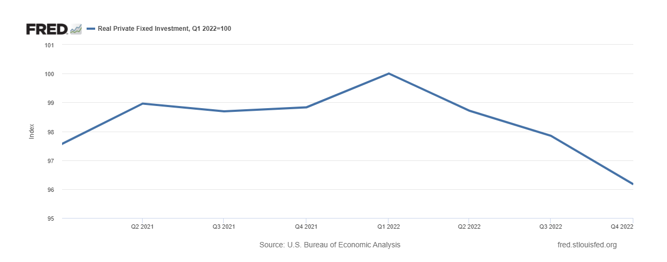

Switching gears, gross private domestic investment declined notably in the third quarter of 2022 (9.6% on an annualized basis) but increased by 1.4% in the fourth quarter. On the surface, this turnaround is good news. However, peeking beneath the hood reveals some reasons to be cautious. Most strikingly, residential investment fell by 26.7% as the housing market gets pummeled by the rapid rise of mortgage rates over 2022. In the first week of January 2022, the average rate for 30-year fixed-rate mortgages sat at 3.2%. In the last week of December, it was at 6.4%. Such a huge increase in rates translates to a jump in monthly payments of over $800 for someone buying a $400,000 house with a 20% down payment—making it more difficult to qualify for a loan.

Looking beyond the housing market, nonresidential fixed investment increased by an anemic 0.7% on an annualized basis in the fourth quarter after growing by 6.2% in the third quarter, a sizable deterioration. As a result, fixed investment overall fell by 6.7% on an annualized basis in the fourth quarter, which is even worse than the 3.5% decline in the third quarter. So how is it, exactly, that private investment still increased by 1.4% overall? The answer: inventories increased, which is far less important for economic growth in 2023 and beyond than businesses confidently investing in new factories and capital.

So what does all this mean for 2023? Unfortunately, not much. The good news is that the economy is not crumbling—at least not yet. And there are also reasons to be hopeful that the Federal Reserve’s interest rate hikes are finally breaking the back of inflation despite the federal government’s fiscal profligacy since the beginning of 2021. However, interest rates are still on their way up, consumers are borrowing more, gas prices are on the rise again, and the housing market is stalling out, with very real prospects of modest to moderate house price declines in at least certain pockets of the country. None of these trends bode well for consumer sentiment or small business optimism. But there’s still a chance that the Federal Reserve can manage to thread the needle, and divided government in Washington, D.C., means that more blowout inflationary spending packages are less likely. It’s certainly something worth crossing our fingers about.