All drivers are familiar with Missouri’s state fuel tax, which raises money for road maintenance.

But what many Missourians don’t know (and even many local leaders) is that cities and counties can implement their own fuel taxes to raise money for local roads. Seven cities in Missouri currently use local fuel taxes to supplement what they receive from their distribution of the state fuel tax (cities get about 16 percent of state fuel tax revenue). These taxes raise up to hundreds of thousands of dollars each year and the cost rarely exceeds 1 cent per gallon for drivers.

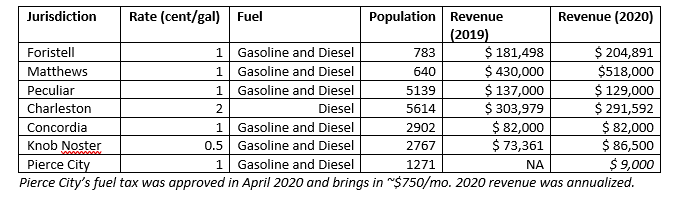

Here are Missouri’s seven cities with local fuel taxes:

Why should more Missouri localities consider local fuel taxes? The most common method of increasing local road funding is sales taxes levied through transportation development districts. But funding roads through sales taxes is fundamentally unfair—people who use the roads should pay for them. People who drive on roads without paying for their upkeep also have no incentive to reduce their driving, resulting in extra pollution, traffic, and road deterioration.

As my colleague David Stokes and I wrote recently, local fuel taxes do a better job of connecting the act of driving with paying for road upkeep. Buying a gallon of gasoline is more associated with driving—and thus how much damage a car does to the road to necessitate its upkeep—than buying a TV or a loaf of bread. Moreover, the money raised by local fuel taxes is constitutionally required to be spent maintaining local roads.

Local fuel taxes are a secret weapon that cities and counties have for adequately funding their roads. They allow municipalities to raise money for local road maintenance responsibly with little room for playing fast and loose with the money.