It’s no secret that Medicaid costs are through the roof. But what if I told you there’s a federal program that’s helping them stay that way? Fortunately, there’s a new effort to shine a light on hospitals abusing the Medicaid financing arrangement to help keep their prices sky high.

For years, I’ve written about Missouri’s reliance on Medicaid “provider taxes” and their role in paying for government-funded health care services. As costs have increased, states have become increasingly reliant on these extra taxes, because they help prop up Medicaid spending by essentially shifting some of the share paid with state tax dollars to the federal government. While this may sound appealing, Missouri’s expected spending on Medicaid has never been higher (nearly $17 billion this year). Provider taxes are a big reason for that, as they make up more than a quarter of all nonfederal Medicaid spending.

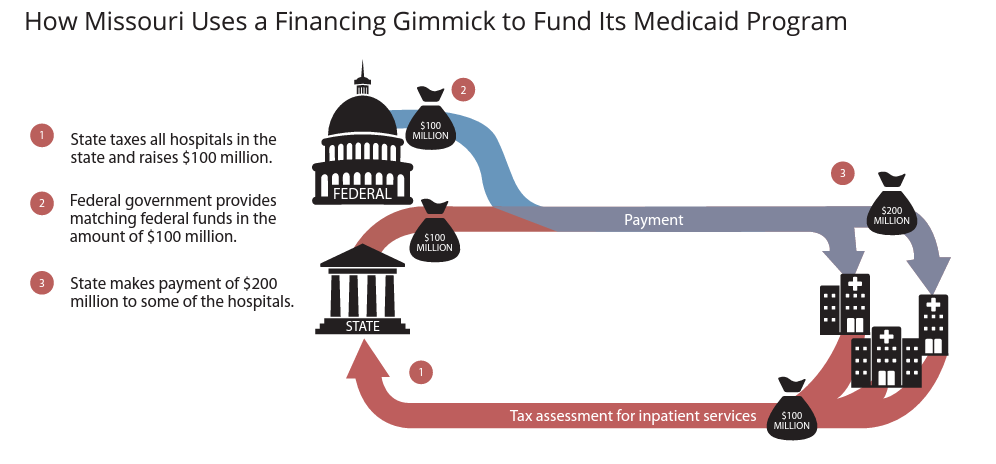

As the graphic below shows, provider taxes aren’t like normal taxes, because they essentially allow different health care providers to exploit the way Medicaid is financed and extract additional federal dollars to help keep their Medicaid rates higher. Beneficiaries of these taxes, (i.e. hospitals, nursing homes, pharmacies, and others) claim they’re one of the only taxes where everyone wins. Well, everyone except for federal taxpayers—which of course includes Missouri state taxpayers as well.

Joe Biden, when he was Vice President, called provider taxes a “scam.” Essentially every audit, congressional report, or presidential administration that looks at these things concludes that they should be seriously scaled back or ended for good. And if that ever happens, Missouri is in serious trouble. Our state is one of the most heavily reliant on this financing gimmick in the country.

Now, I wouldn’t hold my breath for any major federal changes to provider taxes because that would require Congress to make a concerted effort at deficit reduction. But the Biden administration’s new effort to look a little more closely at how states are spending these extra federal dollars warrants greater attention. Since 2002, Missouri has allowed the state’s hospitals to essentially manage its provider tax revenues themselves, with little transparency regarding how or where those funds are being spent. It’s possible a little sunlight might help find some opportunities for savings, or at least give Missouri the kick it needs to start weaning itself off this unsustainable funding source.

If health care costs are going to continue their upward trajectory and Medicaid is going to remain the state’s largest budget item, efforts to rein in spending and root out waste will be necessary and should be encouraged. It’s long past time someone gave a closer look at the provider tax “scam.” I just hope Missouri is ready for what the increased scrutiny might expose.