In the first three blog posts in this series (here, here, and here), we have seen how Saint Louis City’s property tax base is significantly curtailed because much of the city’s land is owned by governments and nonprofits, which pay little or no real property tax. Many other properties also receive special real property tax breaks, like TIF and Chapter 353 abatements, further reducing the number of parcels paying the city’s full property tax rate of $7.5850 per $100 assessed value (with a $1.64 commercial surcharge).

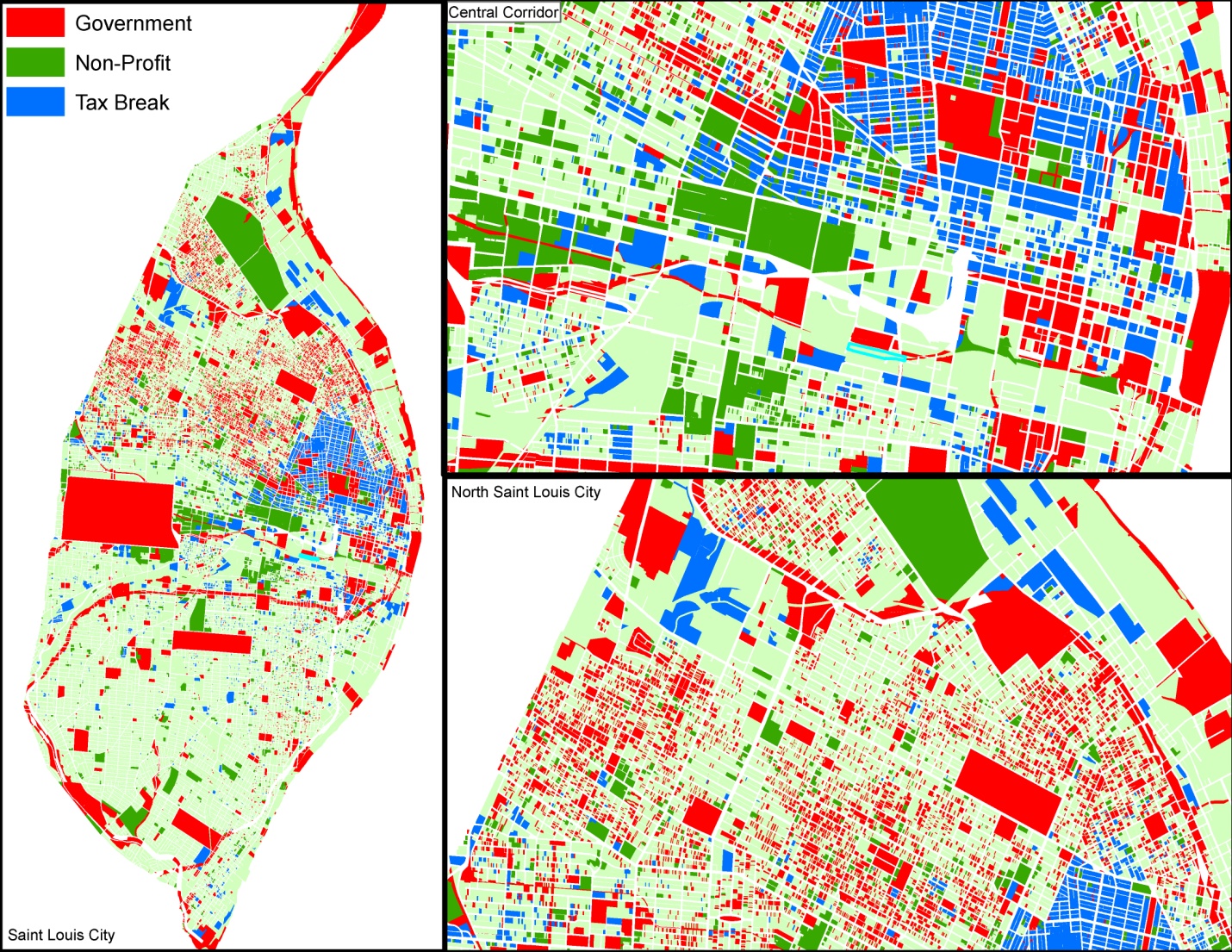

While the share of the city’s property that either gets tax subsidies, qualifies as a non-profit, or is owned by the government is large individually, looking at these issues together shows the scale of the problems confronting Saint Louis’s tax base. In fact, about half of the city’s property by area is either tax exempt or receives tax breaks. Property tax exceptions are basically the rule. The map below demonstrates this:

As we discussed in previous posts, these areas include some of Saint Louis’s most economically important and profitable institutions, such as BJC Healthcare, Washington University in Saint Louis, Busch Stadium, the Eighth Circuit Court, and IKEA. In total, around 40% of the city’s property by value either is tax exempt or receives special tax breaks.

Who is left paying the full property tax rate? For the most part, residential areas on the city’s South (and especially Southwest) side have fewer exempt properties and tax breaks. In terms of value, utilities, casinos, manufacturing and distribution companies, as well as a handful of large businesses downtown appear to pay full property tax rates. However, as the map below shows, when it comes to parcels paying full real property tax levels, the city is hollowed out:

The next post on this issue will discuss some the negative results of this reduced real property tax base, as well as strategies for improving the base.