Humana Announces 2018 Departure from Exchanges

Last year the state health insurance exchanges lost a host of providers as the companies providing the plans continued to hemhorrage money. Importantly, both Aetna and United left because the exchange market was so unprofitable, leaving patients with even fewer coverage options in 2017. Now we have more bad news, according to guidance issued by another company on Tuesday: Humana is leaving the exchanges, too, starting in 2018.

Regarding the company’s individual commercial medical coverage (Individual Commercial), substantially all of which is offered on-exchange through the federal Marketplaces, Humana has worked over the past several years to address market and programmatic challenges in order to keep coverage options available wherever it could offer a viable product. This has included pursuing business changes, such as modifying networks, restructuring product offerings, reducing the company’s geographic footprint and increasing premiums.

All of these actions were taken with the expectation that the company’s Individual Commercial business would stabilize to the point where the company could continue to participate in the program. However, based on its initial analysis of data associated with the company’s healthcare exchange membership following the 2017 open enrollment period, Humana is seeing further signs of an unbalanced risk pool. Therefore, the company has decided that it cannot continue to offer this coverage for 2018. [emphasis mine]

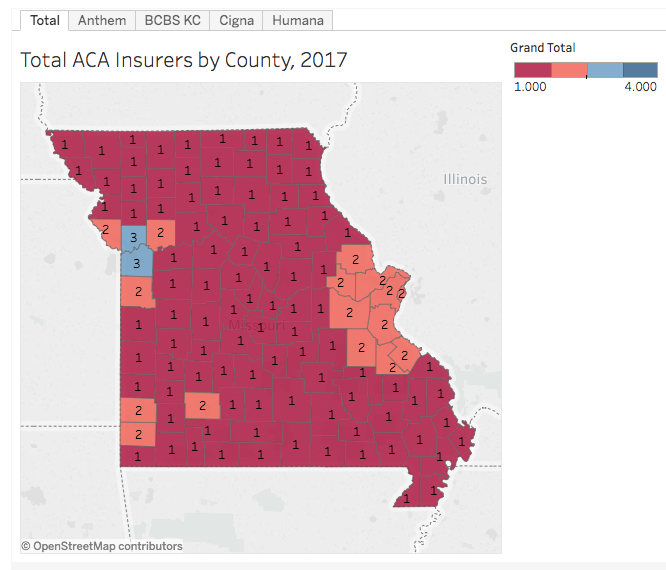

What does Humana’s decision mean for Missouri? Well for starters, in 2018, Jasper, Greene, and Newton counties will likely have only one insurance provider on the exchange, assuming Anthem doesn’t leave (as they’ve hinted they might do) and make that number zero. Options in Jackson and Clay counties in the Kansas City area will also be reduced, from three insurers to only two. To be clear, Humana wasn’t the largest provider of exchange plans by a long shot, but its departure suggests its suboptimal risk pool will migrate to the remaining plans in the state’s exchange, threatening those business models, as well. If, as Humana suggests, the company’s risk pool was too sick to be sustainable as a business model in 2017, it’s reasonable to believe that the remaining exchange providers will see their pools become sicker in 2018, and thus their business models less profitable. In other words, it’s an insurance death spiral.

Below is the insurer count map that I published earlier this year. The difference in 2018? The southwest corner of the state has only one inurer, and in the Kansas City area, all the 3 insurer counties become 2 insurer counties.

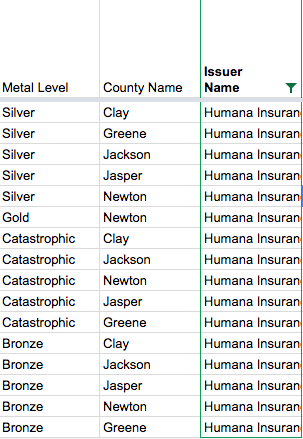

Assuming the accuracy of Humana’s release, the plans listed below will not exist on the Missouri insurance exchange next year.

The failure of the exchanges only serves to reaffirm that the misnamed Affordable Care Act needs to be repealed and replaced with a plan that empowers people and leverages the market to make care more affordable and accessible. We have a few ideas about how to make that happen. It’s time to finally make progress for patients.