The GO Bonds Will Cost You Much More Than You’re Being Told

March 6, 2017: update

Everyone paying attention to Kansas City politics knows that we’re facing an $800 million bond vote on April 4. Previous blog posts here have made the case that the city’s representation of it as a 20-year bond is inaccurate. Now let’s consider the costs.

Anyone who has borrowed money understands that there is a cost to doing so—interest. This additional cost is a consideration in deciding whether to borrow in the first place. So how much will it cost Kansas City taxpayers to borrow $800 million over 40 years? According to the city’s Finance Department, when the debt is finally settled in FY2055, taxpayers will have paid out over $1.28 billion. The city’s own spreadsheet is available at the link below.

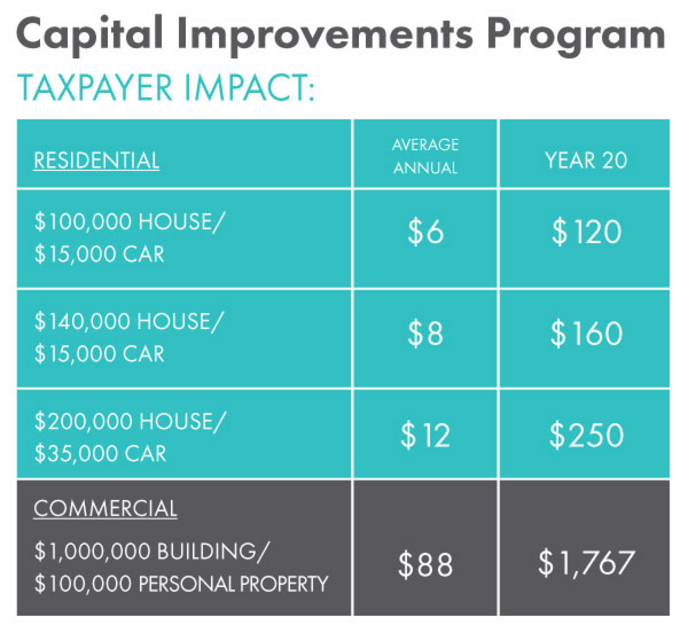

Kansas City’s own website also offers the following infographic, in which the “average annual” cost to someone who owns a $100,000 house is only $6.

That seems like a bargain! However, the graphic is incomplete as it only represents the cost of a single 20-year, $40 million bond. The April 4 election would approve 20 such bonds, issued each year until FY 2036. Start stacking these per-bond costs and you’ll get an idea of the cost to taxpayers. After the last 20-year bond is retired in FY2056, the total amount of taxes paid would be $2,400, not $120.

The city’s infographic is telling 5 percent of the story. The timeframe of the debt is 20 times longer than what the graphic shows, and the cost to taxpayers is 20 times greater. Voters need to know this before being asked to hand over more than a billion dollars.