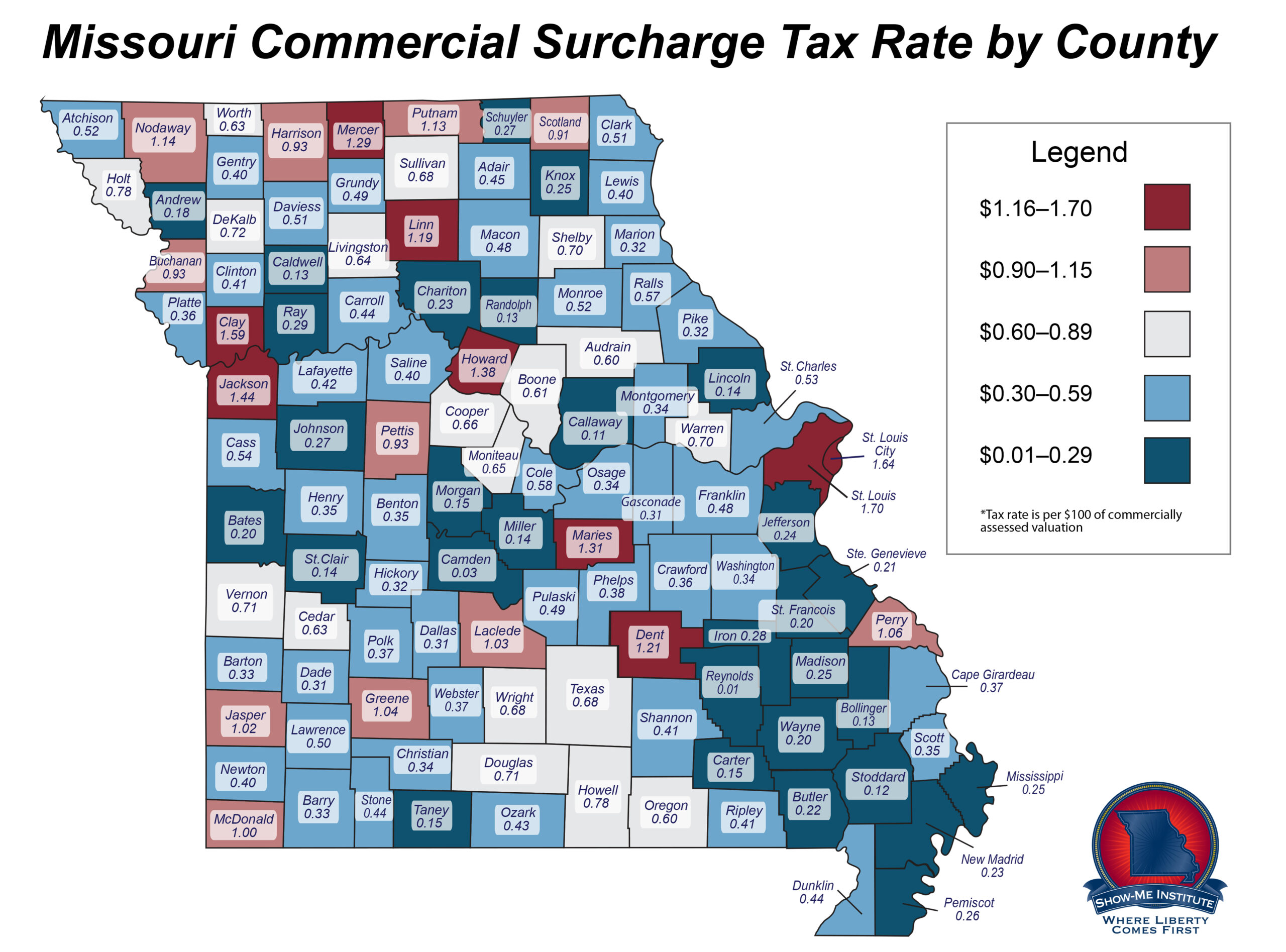

Map of Commercial Property Tax Surcharges in Missouri

I know, I know, if you are like most Missourians, you’ve been talking about the commercial property surtax (or surcharge) constantly over the past few months and you are probably tired of the subject. But stick with me for at least one more post on the subject. As you all undoubtedly know based on your many conversations on the topic with family, friends, co-workers, and if this is actually true, highly likely your therapist, the commercial surtax is a property tax levied at the county level on commercial property only. Unlike other property taxes, it does not adjust downward as assessment value increases and it cannot be lowered by elected officials. Per the Missouri Constitution, it cannot be raised, and only voters can lower it. To date, voters in Missouri have never lowered a surcharge tax rate, but in November, voters in Clay County will have the opportunity to be the first to do so. The modest reduction Clay County is proposing to equalize itself with Jackson County, in my opinion, is very good public policy, but more on that later.

The tax rate varies by county based on the amount of money the tax it replaced—a commercial inventory-based tax—raised in each county in 1985. If your county had many businesses that generated products subject to the inventory tax, such as Clay County with the Claycomo Ford Plant, you probably have a high replacement tax rate. If you are a county that had a lot of businesses that did not generate much taxable inventory, such as counties in the Lake of the Ozarks region with its tourism economy, you likely have a low commercial surtax rate. But the real issue is that because of the difficulty in adjusting the rate, counties still have the rate based on the economic conditions of 1985.

That is why we built this map. The map below shows the commercial surtax rate for every county in Missouri. The redder the county, the higher the rate. The rate varies from $1.70 per $100 of assessed commercial valuation in St. Louis County to $0.01 in Reynolds County. The unweighted average rate is $0.53; the median rate is $0.41. Please check out the map (there is also a download link at the bottom of the post) and see where your county fits.