Pensions Are Taking on Riskier Investments and Putting Retirees’ Money In Jeopardy

A year ago, the Show-Me Institute released “Betting on the Big Returns: How Missouri Teacher Pension Plans Have Shifted to Riskier Assets,” which I co-authored with Michael Rathbone. In the paper, we examined the investments of Missouri’s three teacher pension funds from 1992 to 2014. We saw a remarkable shift in pension investments. Over the fourteen-year period, all three pension funds have shifted to riskier investments. A piece in the Wall Street Journal this week helps explain why this shift is occurring.

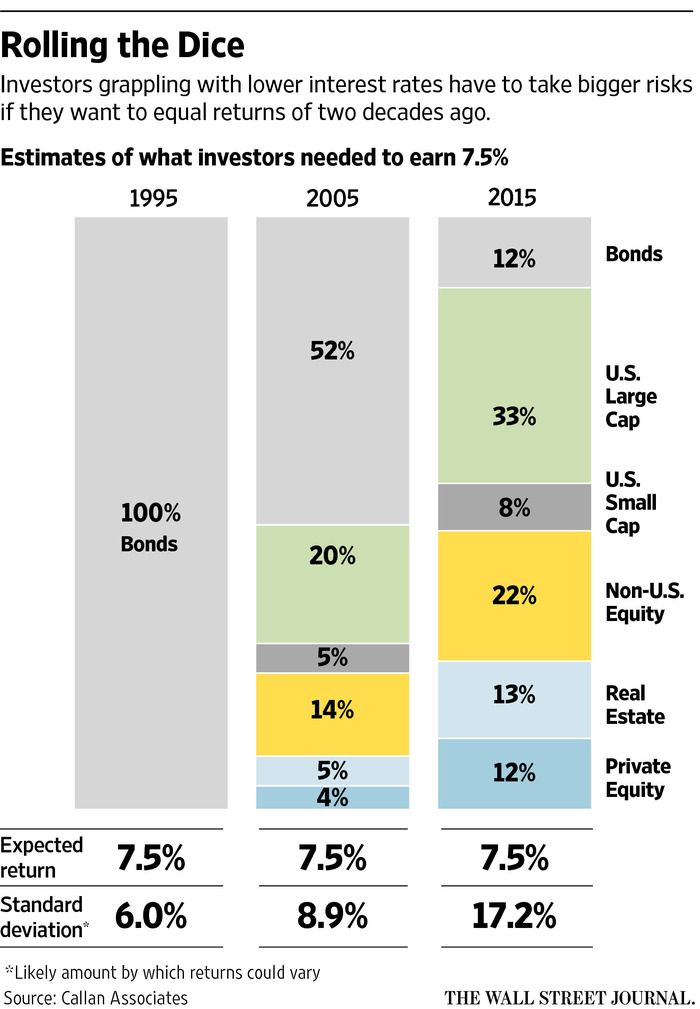

Interest rates for bonds, which are considered low-risk investments, have dropped considerably. Pension systems set investment return goals. For the Public School Retirement System of Missouri (PSRS), the assumed rate of return is 8 percent. The low interest rate on bonds has forced PSRS and other pension systems to chase higher returns by taking on greater investment risk. Timothy Martin of the Journal writes:

Thanks to rock-bottom interest rates in the U.S., negative rates in other parts of the world, and lackluster growth, investors are becoming increasingly creative—and embracing increasing risk—to bolster their performances.

To even come close these days to what is considered a reasonably strong return of 7.5%, pension funds and other large endowments are reaching ever further into riskier investments: adding big dollops of global stocks, real estate and private-equity investments to the once-standard investment of high-grade bonds. Two decades ago, it was possible to make that kind of return just by buying and holding investment-grade bonds, according to new research.

As Michael and I noted in our report, it doesn’t really matter why pension plans are taking on riskier assets; it simply matters that they are. The changing nature of investments has made pension plans riskier. It is incredibly important for pensioners and policymakers to be aware of this. As a safeguard, we suggest policymakers should increase transparency:

To improve transparency, lawmakers could require pension plans to forecast assets using multiple assumptions on investment returns. What would the funding ratio for each of these plans be if returns are 4 percent or 6 percent instead of 8 percent? This is something policymakers should know as it would allow them to choose the best way to structure contributions so that downside is minimized and that these plans can be adjusted to adapt to any unexpected downturns that may occur.

It is time to prepare ourselves for what might happen as a result of taking riskier assets. After all, it is the teachers and eventually the taxpayers who will be held responsible if these plans do not meet their expected rates of return.