A new report released by the Texas Public Policy Foundation documents federal subsidies received by the energy industry over the last decade. While all sources of energy received federal subsidies of varying amounts, some energy sources benefited much more than others.

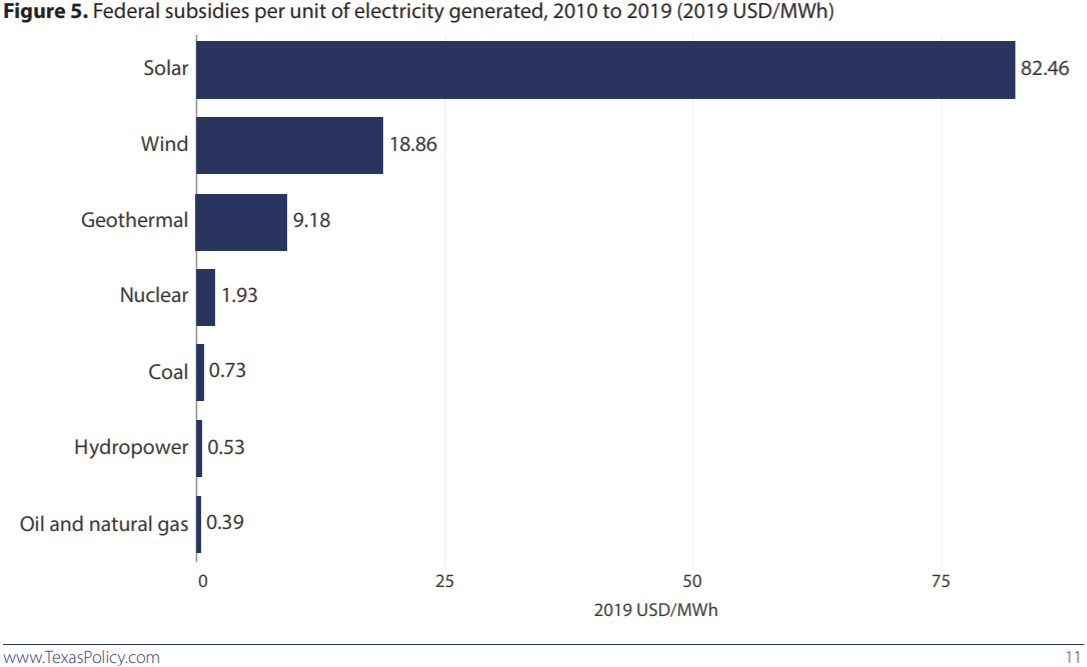

Wind and solar power received the most subsidies in absolute terms, receiving $37 and $34 billion, respectively. When broken down by subsidies relative to the amount of electricity produced, the results are staggering.

The report concluded that wind and solar producers received nearly as much money from subsidies as they did from selling their electricity on wholesale markets.

The report does not provide state-level data, but Missouri is no stranger to these subsidies. While not having much solar power, Missouri has several wind plants. In addition to the Lost Creek wind farm that received $107 million in subsidies from the 2009 federal stimulus bill, numerous wind plants are recipients of the federal Production Tax Credit (PTC), which is the biggest provider of wind energy subsidies in the nation.

The PTC reimburses wind power producers between $15 and $24 per megawatt hour of electricity generated over a period of ten years. The PTC has been extended several times since its inception in 1992. However, it is being phased out and is set to expire at the end of 2020, although IRS rules effectively stretch this to 2022.

The latest Missouri plans to claim more subsidies is a $1 billion taxpayer-funded wind power expansion by Ameren. Construction will begin in time to claim the last of the PTC, a consideration that Ameren noted helped speed up the construction schedule.

The Energy Information Administration, the data branch of the federal Department of Energy, has repeatedly predicted a near cessation of new wind plant construction once the PTC expires. As Warren Buffett, himself the owner of several wind farms, has said: “without the production tax credit” he wouldn’t build them. “They don’t make sense without the tax credit.”

As the PTC expires, we shouldn’t replace it with a state-level program. Missouri borders tornado alley—the nation’s best region for wind power—and it’s time for the wind industry to compete without subsidies and mandates.