If you’ve been in the market for a home recently, you know prices are through the roof. Prices went up sharply when interest rates bottomed out during the COVID pandemic. The low interest rates effectively made houses cheaper relative to the sticker price because most people borrow to buy a home. The lower total price, inclusive of loan interest, stoked demand, and prices went up in response.

Then, interest rates went up.

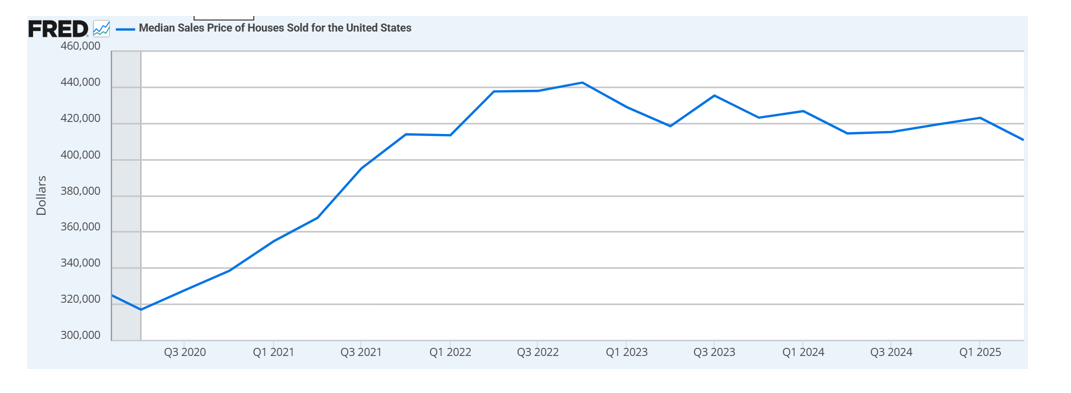

In a well-functioning market, the process should have reversed itself. The higher interest rates pushed the total price of purchasing a home back up, which surely lowered demand. At the same time, with house prices still far above the pre-pandemic level, builders should have been building like mad to bring homes to the market. These two forces should have resulted in a housing price correction. But this is not what happened. The higher interest rates have cooled demand, but prices remain high. Below is a chart I created using the Federal Reserve Economic Data (FRED) system. It shows the trend in the median U.S. home price since February 2020, just before the pandemic. The average price of a home in the United States grew by roughly $120,000, or about 38 percent, from the first quarter of 2020 to the third quarter of 2022. It has declined modestly of late, but not much.

The bizarre thing is that builders haven’t responded to the higher prices. In fact, FRED data show new housing starts today are lower than before the pandemic. Meanwhile, many existing homeowners are “locked in” with low-rate mortgages and reluctant to move, further constraining supply. Even with tempered demand due to the combination of high prices and high interest rates, the lack of supply is keeping prices elevated.

But what are the builders doing? They should be falling all over themselves to bring new houses to the market. Think of it this way: If it was profitable to build homes in Q1-2020, it should have been even more profitable by Q3-2022, continuing until today.

A recent issue of the Journal of Economic Perspectives (JEP) brings together several groups of economists to weigh in on the housing market. I read the issue with great interest. One of the most striking findings is that in many major markets, the price elasticity of housing supply is very low, which means builders barely respond to rising prices with new construction. This is odd. Normally, suppliers should respond strongly to higher prices, which put more money in their pockets. In fact, the invisible hand of the free market depends on it.

The articles discuss several reasons builders have responded so weakly to higher prices. With respect to the recent situation specifically, one might initially blame it on rising construction costs, but the articles suggest this is not the primary explanation. Rather, they emphasize the role of regulations and zoning. Local land-use rules, approval processes, and other restrictions make it slow and costly to build, even when market prices suggest that building more housing should be profitable.

Another interesting finding from the research is that we don’t need to focus on building low-income housing to make housing affordable. If we build higher-end homes, people will move into them from less desirable homes, which will then become more affordable. The effect of building homes at the higher end of the market cascades down.

In short, we just need to get out of the way of the market.

So, the next time you hear complaints about high home prices or a shortage of low-income housing, remember the biggest obstacle is the rules we’ve chosen for ourselves. Deregulating housing construction, and thereby expanding supply, offers the clearest path to putting homeownership in reach for more Americans.