Saint Louis Property Taxes, Part 3: The Tax Breaks

In my previous two posts on Saint Louis City’s real property tax base, I discussed how various government bodies and nonprofits own a significant portion of the city’s land (by area and value). In most cases, these entities pay little or no real property tax to the city, which is likely a contributing factor to the city’s reliance on other forms of taxation to run municipal government.

However, even many private businesses and residences that are not tax exempt in any legal manner receive reduced property taxes from the city or state government. The most common of these tax breaks are tax increment financing (TIF) and tax abatements. TIF allows businesses to use the increase in taxes created by their development to help pay for that development. Tax abatement allows a city to reduce or eliminate property taxes for a development. In some cases the property owner agrees to a negotiated level of payments in lieu of taxes (PILOTs) to offset part of the property tax loss (as the Cardinals have), but this is the exception to the rule. TIFs and tax abatements are often used in tandem, as is the case with the Chase Park Plaza.

The vast majority of these selective property tax breaks were designed to encourage development in economically depressed areas; many (including most TIF) require an area to be designated as “blighted” before property there can receive a tax break. However, over time these incentives have become just another tool city officials use to attract the businesses they want wherever they want, regardless of whether the project is in one of the poorest or wealthiest sections of the city. Blight has been so loosely defined that parcels within Saint Louis City’s most prosperous neighborhoods are regularly deemed “blighted.”

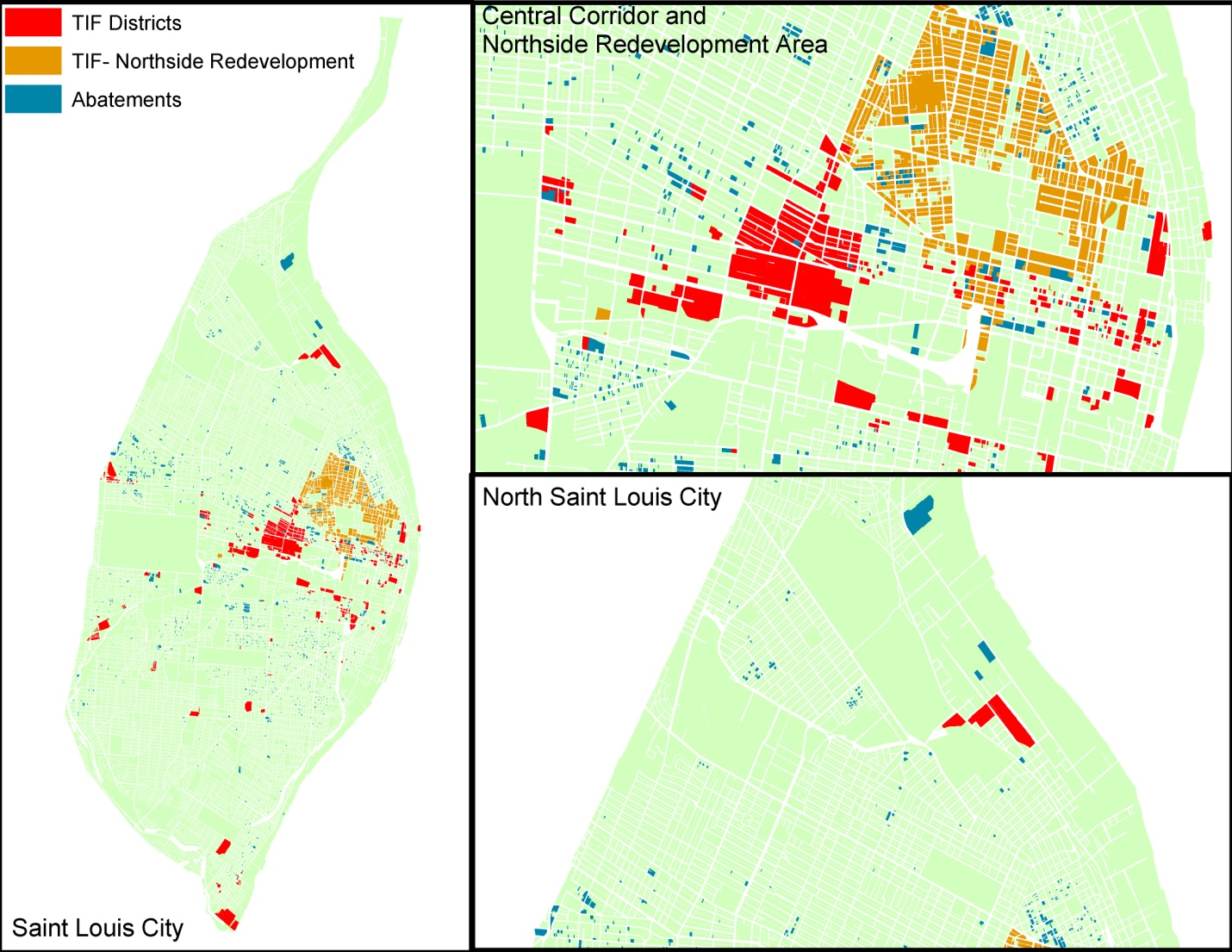

A review of the city’s parcel data shows how pervasive the use of property tax breaks has become. In total, over 9% of the city’s property either receives tax abatements or is in a TIF district (not including government buildings and non-profits that fall within TIF districts). The map below shows all abatements and TIF districts:

Much of the TIF’d area is part of Paul McKee’s Northside Regeneration project, which (whatever the merits of this TIF) does contain many economically depressed properties. However, many valuable properties also receive significant tax breaks, including the Chase Park Plaza, Cortex (which includes IKEA), Ballpark Village, the Renaissance Center, and even a Mercedes dealership on Hampton. Altogether, around 18% of the city’s total assessed value is either in a TIF district or receives tax abatement. Properties in the these areas often pay much less in real property taxes than the city’s official rates would require.

Look for my next post on this issue, which will show the combined effects of government ownership, nonprofits, and tax breaks on Saint Louis City’s real property tax base.